Scott Olson/Getty Images News

Dear Readers,

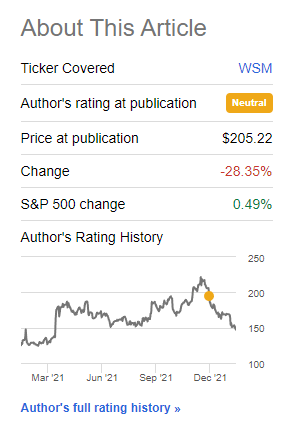

In my last article, I got a not-insignificant amount of general pushback in private messages and comments on my neutral/negative thesis on WSM at a price of over $200/share. However, as I’ve often said in some of my more general articles – investing from time X to time Y is a binary activity. You’re either right or you’re wrong, with the deciding factor being your returns from X-Y.

Williams Sonoma Article

By that definition, between the time I wrote that article and today, the “Neutral” or “wait” stance for Williams-Sonoma (NYSE:WSM), was the right one. This doesn’t mean, of course, that it will always be so.

But what has happened is that we may be looking at an appealing opportunity for investing in the company, after a drop back to the levels we’re seeing.

With that in mind, let’s review this investment.

Revisiting Williams-Sonoma

The first thing we want to do is to actually look at what happened here. My problem in my initial article was valuation. I didn’t see an appealing enough upside on any sort of conservative valuation, especially considering the backdrop of COVID-19 sales, which by their nature might be a non-recurring effect.

In all honesty, I don’t have a good response to what happened here most recently, beyond that we’re looking at a substantialshort interest in the company, almost 10% according to latest numbers (Source: Seeking Alpha). I believe this expresses similar doubts in the recurrence of some of these elevated sales and multiples in the case of the pandemic and the associated trends. What we’ve also seen since we saw a $200+ share price is the company reporting its earnings – and despite strong growth, shares pretty much fell – but I had already published my article at that point.

There is no doubt, as I published in my original article, that Williams-Sonoma is one of the more appealing retailers out there. What I mean is in terms of fundamental key metrics. The company’s return on invested capital is excellent, RoE is good.

The company has challenging public comps, which include Home Depot (NYSE:HD), Lowe’s (NYSE:LOW), TJX (NYSE:TJX), Ross (NASDAQ:ROST), Best Buy (NYSE:BBY), Burlington (NYSE:BURL), and others – and you can certainly make a case for why none of these comps offer exactly what WSM does – I won’t argue that. I will however argue that I see Home Depot and Lowe’s as fundamentally more appealing than WSM due to their price/product mix fundamentals and market positions.

The reason I’m mentioning this is when I last wrote about WSM, the company was approaching LOW-levels of revenue multiples/EV/EBITDA in terms of valuation, and this is not something I saw as relevant or justified in the context. WSM is a comparatively small operator with a <$11B current market cap, compared to HD and LOW carrying market caps of over $500B together. There is no justification in my mind for such a premium in context to these peers, no matter how good pandemic trends are. WSM is a smaller player in a rough industry, and it should be discounted as such – higher than market-leading comps such as LOW/HD.

This combined with what I viewed as challenging valuation and forecast arguments lead me to my stance.

However, I did not expect a near-30% price deterioration in less than 3 months – and this necessitates my changing my stance on the company.

Recent results in no way justify a price drop this extreme. As we will see in the next article section, this move has pushed WSM firmly into undervaluation territory, where I am happy to establish a baseline position in the company with a “bullish/buy” stance.

The core issue here seems to be that the market doesn’t believe in the sustainability of the company’s positive momentum here, and that continued growth is likely. I, therefore, view it as important to consider the company conservatively in a forward context, because while the company has increased EPS by double digits in 2021E, this hasn’t been true historically, seeing a more conservative EPS growth rate of around 2-7%.

Again – company fundamentals are solid. The only thing the company lacks is a credit rating. But company debt, nor company fundamentals aren’t the issue here.

Valuation is.

The valuation has improved

As I said, following the most recent drop, this company’s thesis is changed. I am unwilling to consider the company’s 2021 growth rate anything approaching indicative for the long term. It’s a one-off, and we should model for either reversal to more conservative cash flow growth rates, or at the very least flat, not positive, for the longer term.

Analysts agree. FactSet is forecasting a negative 1% 2023 EPS growth rate, and S&P Global is forecasting a negative 3.5% in 2023E, as well as a negative 20.4% FCF decrease. If you view there being a realistic catalyst for future cash flow growth on par with 2021E-2022E, currently estimated in the double digits, and for the company to maintain this, I would love to hear it.

We deal with what is given to us, dear readers.

Fortunately, what we’re being offered is very appetizing indeed.

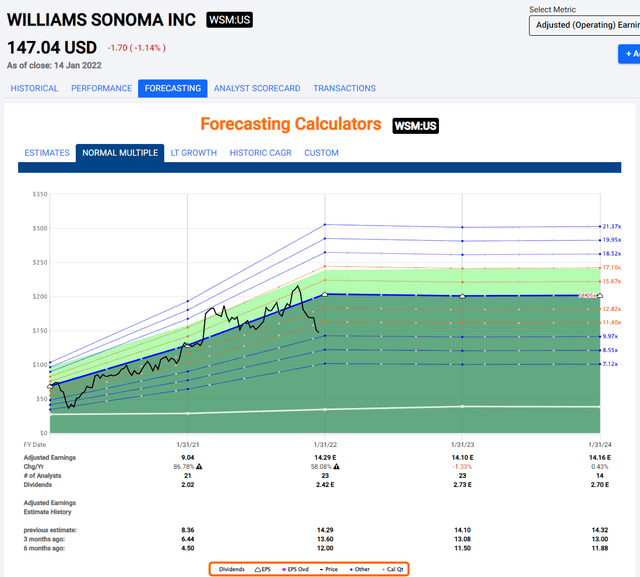

F.A.S.T graphs – Williams Sonoma

F.A.S.T graphs

What was previously less than 4% even on a positive conservative estimate has turned into a solid opportunity of over 18.2% annualized on a 14.25 forward P/E.

Even if this company were to maintain only a 12-13X P/E, your returns would still be market-beating, going by current forecasts. It would take below 12X for returns to become lower than 7%, and below 10X P/E for returns to turn negative on you.

Williams-Sonoma is a classicvaluation exercise, as I see it. If you buy something expensive, you’ll be dragging your heels in the dirt for potentially years before seeing those sweet returns.

If you, however, stick to your guns and buy cheap quality, then you’ll be rewarded with what I see as easy returns.

And who doesn’t want easy returns?

But couldn’t WSM keep dropping from here? Of course, it could! That’s why I’ll buy my position in steps. But at this valuation, I don’t really care if it drops a whole lot lower, because I’ll have bought at a great price.If you bought it 3 months ago, you clearly did not buy it at a great price.

Why?

Because not only have you lost 30% of your investment, your original investment only had a 4% annualized RoR upside, to begin with. You are now stuck between either holding that investment at a loss until you claw back into the green – or selling it in the red, a decision none of us should have to make.

Dear readers,

To me, the decision to sell a stock because your investment “failed” in terms of RoR or because you’re uncertain, means one of two things.

- You didn’t buy the company at a high enough upside/cheap enough relative to your expectations, or

- You didn’t do enough due diligence/homework on the company, leading you to misestimate or mischaracterize your possible returns, relative to your expectations.

It’s no more difficult than that.

That’s why I have very strict return and valuation demands, even in times when I’m being deeply questioned about them.

However, at these levels, Williams-Sonoma is fulfilling my demands. The market is offering me a near-20% annualized upside at a conservative, below 15X P/E. Even if the company’s EPS forecasts were to turn negative, my forecasts show me that I wouldn’t be losing money here.

Analysts now have average price targets of $200/share. Notice anything about those? Even normally exuberant S&P Global isn’t close to over $200 anymore, despite being at $210 last time I wrote my article (Source: S&P Global). I also mentioned in my last article, that $200 would still consider other companies better – so I didn’t buy at $200 either. S&P Global has now lowered its targets, and it gives the company a conservative upside of 37.2%.

My price target based on current estimates and myself not wanting a significant possibility of losing money is lower than in my last article, given recent forecast updates, and I’ve cut it to$185/share.

At $185, you’ll still make decent returns on a 14.5X forward P/E, but anything above that, and you’re looking at less than 6% conservatively.

However, at $147, we have an upside of no less than 25% to my price target, and 37% to analyst price targets.

Based on these and the company’s solid fundamentals, I consider this company a “BUY” here.

Thesis

My thesis for WSM is:

- The company remains as fundamentally sound as in my original article, with the difference of being more than $50/share cheaper at a nearly 2% annual yield. This significantly changes my thesis.

- I’m moving to a “BUY” on Williams-Sonoma with a price target of $185 – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

- What investors need to watch is the EPS growth rate going into 2022-2024. If the pandemic trend turns, this could affect future returns significantly.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Williams-Sonoma is currently in a position where #1 is possible in my process, through #3 and #4.

Thank you for reading.

from WordPress https://ift.tt/3IhquGD

via IFTTT

No comments:

Post a Comment