NeilLockhart/iStock via Getty Images

Investment Thesis

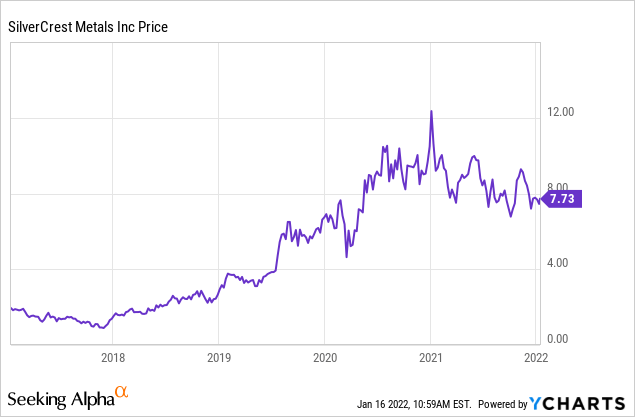

SilverCrest Metals (SILV) has over the longer term had a fantastic performance, beating most peers, metals, relevant indices, and ETFs. However, the stock price has been about flat over the last two years even though the price of silver has increased during that period.

Figure 1 – Source: YCharts

The recent lackluster share price performance is likely due a very significant run-up prior to 2020 and the less exciting feasibility and development phase of the Lassonde Curve. However, commissioning is now not far off, which means the stock has the potential to rerate provided everything in the build phase continues to go according to the plan.

Las Chispas Commissioning

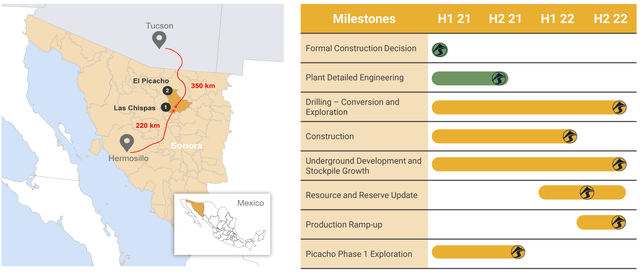

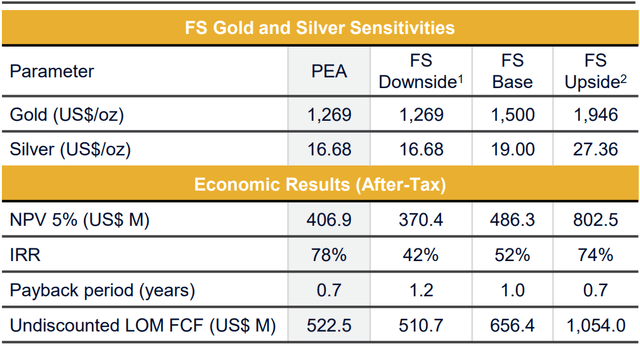

SilverCrest is primarily valued on the core Las Chispas project, with commissioning scheduled for Q2 2022, and production ramp-up expected in the second half of this year.

Company Presentation

Company Presentation

Figure 2 & 3 – Source: SilverCrest January 2022 Presentation

Construction is so far tracking slightly ahead of schedule, with 54% completed in Q3 2021 compared to 48% planned at that point. The total capital spend is also tracking well against the budget, where most costs will at this point be confirmed. So, there is little chance of any significant cost overruns for the project.

The company is also very well-capitalized, with $199M in cash as of Q3 2021, and approximately $59M in capital left to be incurred through commissioning. So, there is plenty of liquidity if there were to be any delays with the commissioning and consequently cash flows from the project.

Valuation

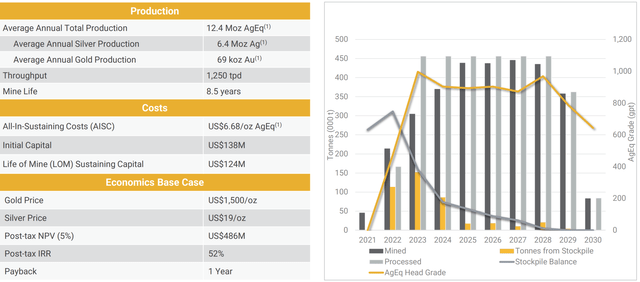

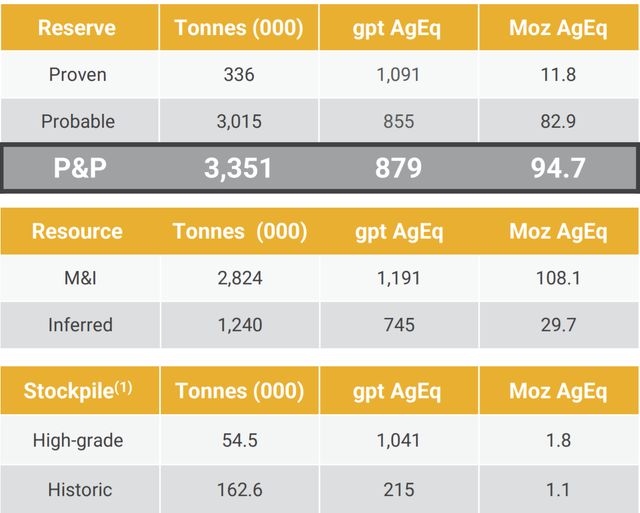

The below table provides the net present value of Las Chispas at a few different metal price scenarios, where current prices are somewhere between the feasibility study base and feasibility study upside scenarios.

Company Presentation

Figure 4 – Source: SilverCrest April 2021 Presentation

If we use the latest spot prices of $1,800/oz for gold and $23/oz for silver, we get an NPV of approximately $670M with some interpolation.

The company did as of Q3 2021 have 145M common shares outstanding, if we disregard the options, shares units, and use the latest share price. We get market cap of $1,121M and a market cap to NPV of 1.67.

Resource Update & Exploration Potential

It is important to remember that apart from the reserves, the company has plenty of resource, which are presently not part of the mine plan. There has been quite a lot of drilling since the last update, where there is another reserves and resource update planned for 2022. That update has the potential to boost reserves significantly and extend the mine life of the project.

“Only 15 of more than 45 known veins included in the Reserve Estimate.” / Corporate Presentation

Company Presentation

Figure 5 – Source: SilverCrest January 2022 Presentation

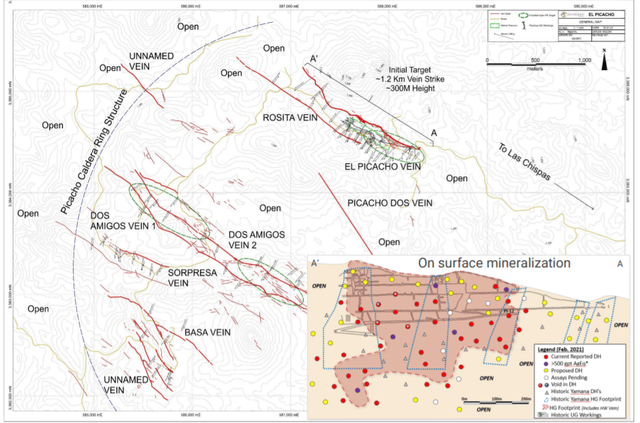

Apart from Las Chispas, the company has also started to drill at El Picacho, which is located within 85km trucking distance from Las Chispas. The results have so far been very encouraging with 21 holes averaging 4.1 meters in width grading 8.14 g/t gold and 49.7 g/t silver. There are presently 3 drill rigs operating at El Picacho.

Company Presentation

Figure 6 – Source: SilverCrest January 2022 Presentation

Conclusion

There are so many things to like about SilverCrest Metals. It is a fully financed development company, close to production, with extremely good grades, and very low operating cost. The company also has exploration potential.

The company has done an excellent job of taking the project from exploration to close to production in a compressed time frame without excessive equity dilution, which is no small feat.

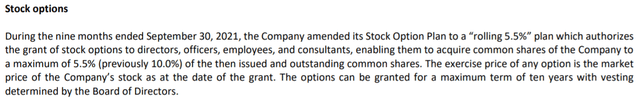

Management in some junior exploration and development companies can make very poorly timed capital allocation decisions and overcompensate their insider dilution by very excessive option issuance. However, SilverCrest has gone in the opposite direction decreasing the maximum number of options allowed to 5.5% from 10% prior to Q3 2021. That is something which I think should be celebrated.

Figure 7 – Source: Q3 2021 Financial Statement

However, one minor concern is that there are quite a lot of delays in Mexico due to Covid-19. So, while I would not worry too much about cost overruns, there is still the potential for delays as we saw with MAG Silver’s Juanicipio project not too long ago. Given the good liquidity position, I expect the impact from potential delays would be very manageable.

For me, the valuation is still not attractive enough to buy the stock, where I think much of the resource update and some further exploration success seems to be priced into the stock already. I can definitely see upside surprises in 2022 due to all the catalysts, or from positive metal prices, but there are in my view other quality projects with more enticing valuations.

from WordPress https://ift.tt/326gbG5

via IFTTT

No comments:

Post a Comment